On February 28, 2021, the international community observes the 14th Rare Disease Day, which is a time of the year to raise awareness among the general public and to also reflect upon the progress of orphan drugs development. There are approximately 7,000 existing rare diseases in the world, and less than 10% of them have an available treatment.[1] In China, around 20 million patients suffer from 1,400 known rare diseases.[2] The best medical resources and experts in China are concentrated in megacities like Beijing, Shanghai, and Guangzhou. Patients from small cities and rural areas are disadvantaged due to this uneven distribution. Besides geographic barriers and the hardship of diagnosing the rare diseases, the cost of treating them is also a challenge for most patients.

In recent years, government agencies in China have been more active in promoting the interests of rare disease patients. In 2018, the National Health Commission (NHC), along with four other ministries and agencies, published the First National List of Rare Disease, which included 121 rare diseases that the NHC deemed prevalent, highly burdensome, and treatable.[3] In estimation, these 121 rare diseases affect more than 3 million patients in China.[4] This list not only provides official recognition for the most prevalent rare diseases, it also offers incentives for pharmaceutical companies to develop rare disease drugs and market their products in China.

On August 26, 2019, a new amendment to the Drug Administration Law was passed. Article 96 stipulates that there will be an accelerated and prioritized review and approval mechanism for rare disease drugs.[5] Compared to the standard review time of 200 working days, the priority review would only take 70 working days for the rare disease drug products which have been marketed abroad. As of December 2020, the National Medical Products Administration has approved 95 rare disease drugs for the rare disease on the list mentioned above.[6]

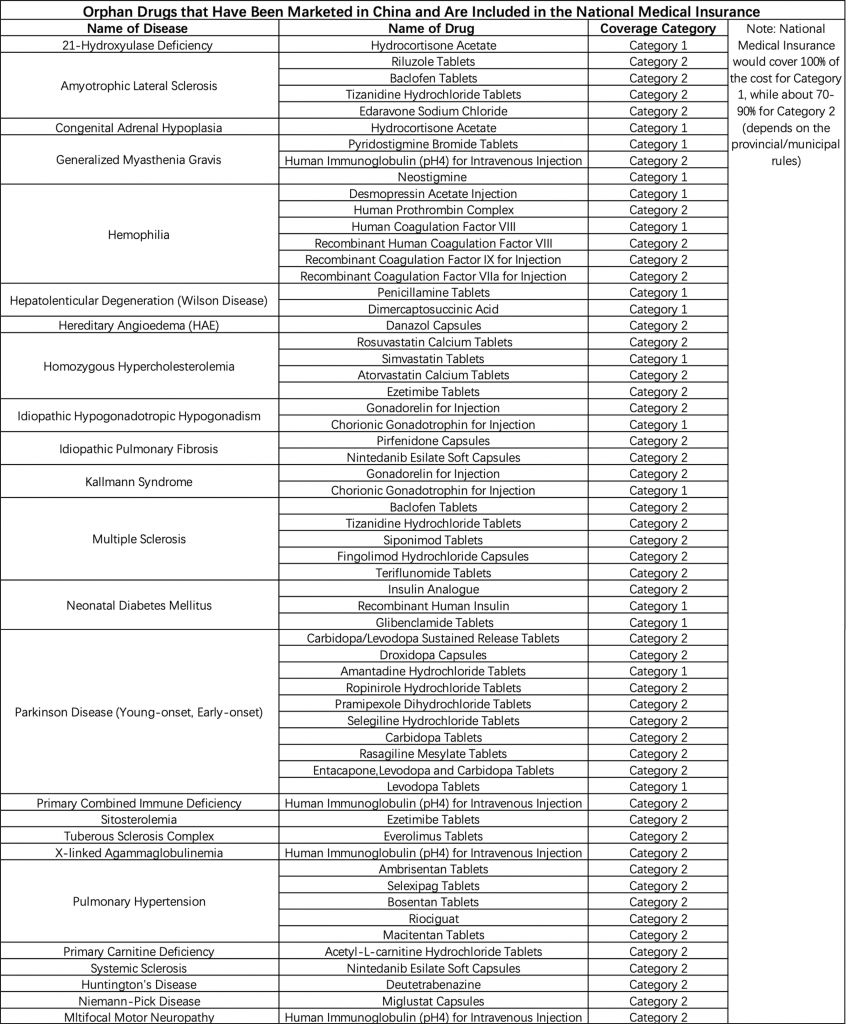

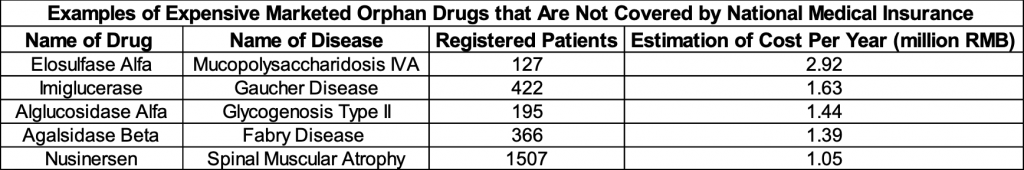

As greater number of rare disease drugs become more accessible, the issue of affordability deserves more attention. In recent years, the Chinese government has been more involved in negotiating with pharmaceutical companies about introducing rare disease drugs into the medical insurance system. For example, the price for Ambrisentan Tablets, a drug that treats pulmonary hypertension, went from 115.97 RMB to 20 RMB per pill after the government’s negotiation for centralized procurement.[7] Currently, China’s national medical insurance covers 55 orphan drugs, which target 24 different rare diseases (Table 1).[8] Despite having major progress, many rare diseases patients in China still struggle to afford their treatment. Table 2 shows several of the most expensive marketed rare disease drugs that are not yet covered by national medical insurance. Notably, Nusinersen, an injection drug that treats spinal muscular atrophy (SMA), received widespread notice on social media platforms in August 2020 due to its ultra-high price in China. Approximately 20,000 Chinese patients suffer from SMA and struggled to afford the 700,000 RMB per shot price.[9] This rare disease drug was approved to be marketed in February 2019, but it has not entered the list of drugs covered by national medical insurance.

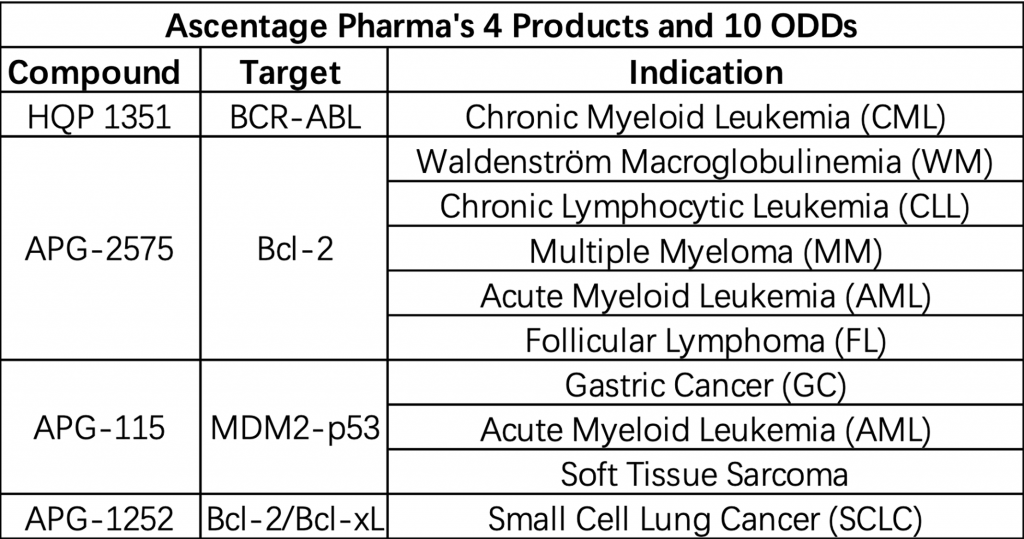

Besides relying on foreign rare disease drugs, domestic pharmaceutical companies have been increasingly active in this field. Throughout 2020, 26 products of 19 Chinese pharmaceutical companies received 35 different Orphan Drug Designations (ODDs) from the U.S. Food and Drug Administration (FDA).[10] The vast majority of the ODDs received by Chinese companies focus on the treatment of tumor, like lung cancer, T-cell lymphoma, and soft tissue sarcoma. Four products and 10 ODDs (2 of them are approved in January 2021) make Ascentage Pharma the biggest winner in China in 2020 (Table 3). Notably, the company’s novel Bcl-2 inhibitor APG-2575 alone received five different ODDs, including treatment for acute myeloid leukemia (AML), Waldenström macroglobulinemia (WM), chronic lymphocytic leukemia (CLL), multiple myeloma (MM), and follicular lymphoma (FL).[11] Currently, Ascentage Pharma’s APG-2575 has received permission to conduct phase II clinical trial in China, the United States, and Australia.

Looking ahead, as the Chinese government makes substantial progress in improving its policies regarding rare disease, and as the general public becomes more aware of this phenomenon, the domestic market of rare disease drug has great potential to expand. Besides monetary profits, the development of rare disease drug is also in line with many corporations’ vision to be socially responsible in the present era. Taking these factors into consideration, more Chinese pharmaceutical companies now have the incentives to venture into this previously unattractive field.

Table 1: List of Rare Diseases and Orphan Drugs Covered by the National Medical Insurance.

Source: Illness Challenge Foundation.[12]

Table 2: Expensive Marketed Orphan Drugs that Are Not Covered by National Medical Insurance.

Source: An Overview of Rare Disease in China (2021).[13]

Table 3: Ascentage Pharma’s 4 Products and 10 Orphan Drug Designations.

Source: Cision PR Newswire.[14]

[1] China Rare Disease Drug Accessibility Report 2019.

http://www.cord.org.cn/companyfile/17.html

[2] An Overview of Rare Disease in China (2021).

http://www.chinaicf.org/Uploads/2021/0228/907737d9a2fbaa07faacdae2ddc9b994.pdf

[3] The First National List of Rare Diseases.

https://www.nrdrs.org.cn/app/rare/disease-list.html

[4] An Overview of Rare Disease in China (2021).

http://www.chinaicf.org/Uploads/2021/0228/907737d9a2fbaa07faacdae2ddc9b994.pdf

[5] Drug Administration Law of the People Republic of China.

http://gkml.samr.gov.cn/nsjg/fgs/201909/t20190917_306828.html

[6] An Overview of Rare Disease in China (2021).

http://www.chinaicf.org/Uploads/2021/0228/907737d9a2fbaa07faacdae2ddc9b994.pdf

[7] National Healthcare Security Administration: Efforts Are Being Made to Cover Orphan Drugs in National Medical Insurance.

https://m.sohu.com/a/419982080_464397

[8] An Overview of Rare Disease in China (2021).

http://www.chinaicf.org/Uploads/2021/0228/907737d9a2fbaa07faacdae2ddc9b994.pdf

[9] Current Status of SMA Patients in China.

https://baijiahao.baidu.com/s?id=1674374116654573184&wfr=spider&for=pc

[10] 19 Chinese Pharmaceutical Companies Received 35 ODDs from the FDA

http://www.phirda.com/artilce_23246.html

[11] Ascentage Pharma Received Its 10th FDA-Granted ODDs.

https://mp.weixin.qq.com/s?__biz=MzUxMTY5MzM5OQ==&chksm=f96d5d9fce1ad489efbaa9310276c173e92e825b1009c29dace62afb5e8319180bdb5634c24d&idx=3&mid=2247506599&sn=453c99c406e7765bf5e8b1528daa6f87

[12] China’s National Medical Insurance Covers Six New Rare Disease Drugs.

https:// mp.weixin.qq.com/s/TXTKoBUrcr9LgX7fyXhU7A

[13] An Overview of Rare Disease in China (2021).

http://www.chinaicf.org/Uploads/2021/0228/907737d9a2fbaa07faacdae2ddc9b994.pdf

[14] Ascentage Pharma Announces its 9th Orphan Drug Designation from the US FDA in 2020, Setting a Record for Chinese Biopharmaceutical Companies.

https://www.prnewswire.com/news-releases/ascentage-pharma-announces-its-9th-orphan-drug-designation-from-the-us-fda-in-2020-setting-a-record-for-chinese-biopharmaceutical-companies-301200596.html.